- January 31, 2023

- Start & Scale E-Learning Series

The below post is from @OnlyCFO who are a great source of financial information and you can follow them on Twitter at (@OnlyCFO) / Twitter

The income statement is one of three primary financial statements:

- Balance Sheet – Read our other post on: How to Read Balance Sheets

- Income Statement

- Statement of Cash Flow

All three of these statements are prepared in accordance with GAAP (Generally Accepted Accounting Principles) for US companies or the international version for foreign-based companies. These are the accounting rules for how everything should be accounted for, but they are frequently updated and changed.

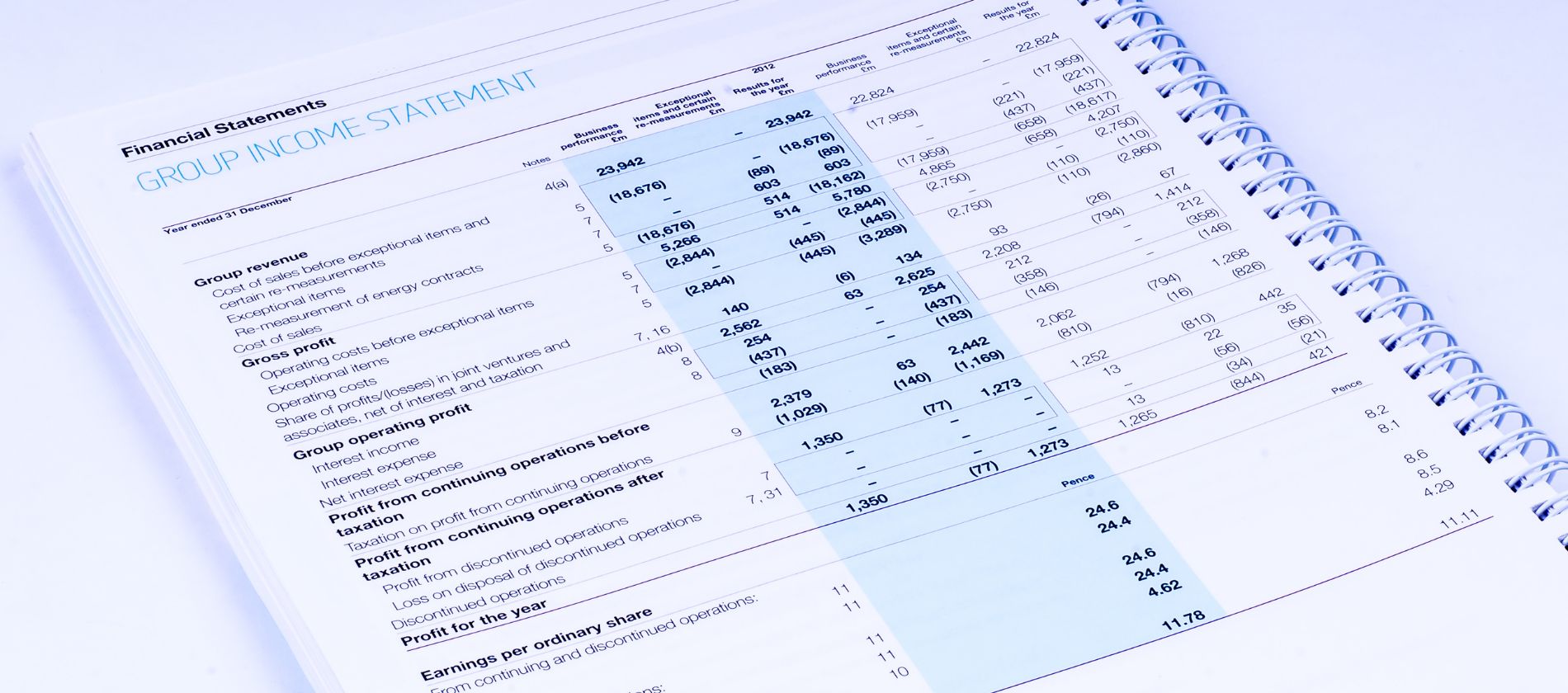

Below is CrowdStrike’s 2022 income statement.

Income Statement Cheat Sheet

Below is the quick cheat sheet on the main income statement lines. If you want the detail and explanations then keep reading…

Revenue

SaaS companies usually have two categories of revenue:

- Subscription revenue – the “good” revenue

- Professional services & other – considered either bad or neutral revenue

If the professional services revenue is immaterial, then a lot of companies will just show one line called “revenue” on their financials. For internal management reporting all major revenue categories should be broken out so each revenue type can be reviewed separately.

SaaS Revenue

Depending on who you are talking with, the word “revenue” can mean a dozen different things at SaaS companies. Check out the below tweet storm on the differences in a lot of these acronyms.

On the income statement when we say “revenue” we are referring to GAAP revenue. All other commonly used acronyms about “revenue” such as ARR, CARR, and ACV are annualized amounts. For GAAP revenue these amounts must be spread across the period that the service is delivered (subscription or usage period).

There are two main types of SaaS revenue recognition models (and there are various degrees of hybrid models in between):

- Consumption-based pricing models

- Term-based subscription model

Below are the typical revenue recognition rules, but each company’s specific facts may impact how revenue is recognized. Many thousands of pages have been written on this topic because it’s complex!

Consumption-Based Pricing (aka usage-based)

For companies with a pure consumption-based pricing model, GAAP revenue will be recognized as consumed.

Example: Company ABC signed a $120K deal for 10 GB of data usage on January 1st, 2023.

Solution: Revenue is only recognized as it is consumed so usage-based pricing revenue may be lumpier that the traditional SaaS model.

Consumption-based pricing revenue is seasonally impacted

“And also Q4, as I said, is one that has seasonally higher number of holidays with people taking — and remember, about 70% of our revenue is tied to human interaction with our system, 30% is really driven by scheduled jobs. So, that has an impact.” –Mike Scarpelli (Snowflake CFO)

Consumption-based pricing revenue is more impacted by the macro environment

“We recognize revenue based on customer consumption of our platform, and that consumption is closely related to end-user activity of the application, which can be impacted by macroeconomic factors.” – Michael Gordon (MongoDB CFO)

Subscription Pricing (term based)

This is referring to the traditional SaaS pricing model. This can be a number of seats or licenses that you have access to for the term of the contract – doesn’t matter how much you use the software.

Example: Company ABC signed a $120K deal on January 1st, 2023 for 5 seats for a subscription term over the next 12 months.

Solution: Revenue is recognized ratably over the subscription term. This is true regardless of the usage level because it is continually available to be used throughout the subscription term.

Professional Services & Other

This revenue is almost always broken out from subscription revenue unless it is so immaterial that it doesn’t really impact gross margins. Most investors look at professional services revenue as either bad or neutral to a company’s valuations because of the following:

- Professional service gross margins are usually very low (or even negative) for SaaS businesses.

- The scalability and distribution of SaaS are why it can grow so fast. Service businesses just can’t do that because of the reliance on people.

- High professional services may mean people are making up for a bad SaaS product.

- If implementation services are high due to product complexity, then the distribution of the SaaS solution might be significantly slower.

When is professional services revenue recognized?

Depends. Typically professional services are recognized as they are performed.

But the revenue might need to be recognized over the term of the software subscription if:

- The services significantly customizes the SaaS solution

- The services from the company are required in order for any value to be obtained from the SaaS solution

Most SaaS companies are able to recognize professional service revenue as it is performed.

Cost of Revenue (COGS)

A lot of people just say “COGS”, which stands for cost of goods sold, but there aren’t any “goods” in pure SaaS so when it is reported on financial statements this line just says “cost of revenue”.

Cost of revenue is broken out the same way that revenue is broken out:

- Cost of revenue – subscription

- Cost of revenue – professional services and other

Cost of Revenue – Subscription

The major categories that are included here include the following:

- Customer hosting costs – AWS, GCP, Azure

- Support team – responding to customer support tickets

- Dev Ops – people ensuring uptime and reliability of accounts

- Software and other costs for the teams above

- MAYBE customer success – see below

Most SaaS companies are fairly consistent with these groupings with a few exceptions:

- Early-stage companies aren’t great at properly breaking things out and allocating the right things to COGS. I almost never trust COGS for companies less than $15M ARR and a built-out accounting team.

- Customer Success: Even in public companies there is diversity on whether this team lives in COGS or S&M (or how they are allocated between the two). Companies have to determine what their customer success team is actually doing to determine where it should be recorded on the income statement, but there will always be an element of judgment. Accounting rules aren’t black and white for this. My thoughts on how to categorize customer success below.

Investors need to make sure they understand what is being included/excluded in COGS so they can make informed decisions when comparing it to other companies.

Cost of Revenue – Professional Services & Other

Professional services COGS is pretty straightforward:

- People costs for delivering the services

- Software and other people-related costs to deliver the services

- Costs for any other revenue generated

Gross Margins

Gross margins tell you how much (either as a $ or % of revenue) profit you have after subtracting COGS from revenue. In the formula below, we can see gross margin expressed as a percentage of revenue. Viewing gross margin as a percentage of revenue is generally more useful because then it is comparable across benchmarks and other companies.

Gross Margin = (Revenue – COGS) / Revenue

COGS is a very protected financial expense group because SaaS company valuations are (or at least should be) highly correlated with gross margins.

SaaS vs Professional Services Gross Margins

As noted earlier, there is a reason investors typically view professional services revenue as either bad or neutral in their investment decisions. Professional services’ gross margins are very low when compared to SaaS gross margins.

Having said that, Crowdstrike’s professional services gross margins are phenomenal at 33%….Most SaaS companies either lose money or break even on professional services for a long time and may only be slightly profitable at scale.

But the ability to have subscription gross margins of 76% with essentially limitless distribution is what makes SaaS so special.

Below is a table from Clouded Judgement for the highest valuation multiple companies and it shows the average gross margin is 74%.

Operating Expenses (aka “OpEx”)

The operating expense section of a SaaS company’s income statement almost always has the following categories:

- Sales and marketing (S&M)

- Research and development (R&D)

- General & administrative (G&A)

What is included in each category?

Sales and marketing (S&M)

- Sales team payroll (AE, SDR, SEs, sales management, etc)

- Marketing payroll (demand gen, PR, events, comms, etc)

- Customer success payroll (see COGS section on debate between COGS and S&M)

- Rev ops and sales enablement

- Software and other non-headcount costs for these teams

- Trial hosting costs (such as AWS)

Research and development (R&D)

- Engineering, product, and design team payroll-related costs

- Software and other non-headcount costs for these teams

- Dev infrastructure costs (such as AWS)

- Note – a lot of earlier-stage companies don’t properly break these costs out properly between COGS, R&D, and S&M

- Quality assurance (QA)

General & administrative (G&A)

- Finance, legal, HR, and other executive payroll-related costs

- Corporate insurance

- Financial audits

- Charitable contributions

Specific Callouts in OpEX

In addition to these core expense groups that show up on the income statement, there are a couple of key expense callouts that you should also understand so you know how to compare the income statements of different companies.

Allocated Departments

There are certain expenses and teams that are frequently allocated across all of the above expense groups based on relative headcount (or some other reasonable allocation methodology). These are judgemental and there is sometimes diversity in how they are treated.

- IT – people and software the entire company uses

- Recruiting – internal recruiting resources

- General – Facilities, company offsites, etc

Understand how they are coded versus other companies so proper comparisons can be made.

Stock-Based Compensation (SBC)

SBC has recently been a hotly discussed topic amongst tech companies as a result of the implied shareholder dilution that results from sky-high equity awards given out in Silicon Valley.

Here are the basics that you should know about SBC:

- SBC includes all equity-based awards that are given to employees, consultants, advisors, etc.

- Equity awards may include: stock options, RSUs, RSAs, PSA, SARs, etc

- SBC expense is based on

- The fair value of the award on the date of the grant. This is important because if the stock price subsequently shoots up or crashes, then that is not reflected in SBC expense.

- SBC expense is recognized over the vesting term (i.e. the period of time the equity award is earned). For tech companies, somewhere around 95% of companies have equity awards that vest over 4 years.

Based on the above, you need to understand that SBC expense does not equal the amount of dilution. Especially during times of high stock price volatility, the SBC expense and shareholder dilution can diverge significantly.

Below is an interesting chart from Guggenheim on SBC % based on growth rates.

Sales Commissions

This is an area that the accounting rules has changed in the last few years. Prior to the accounting overlords changing the rules, most SaaS companies expensed sales commissions in the period they were earned by the sales folks.

Under the new accounting rules, most sales commissions for SaaS companies get capitalized on the balance sheet (i.e. not expensed immediately) and then expensed over a period of time determined through some judgment. Almost all SaaS companies expense sales commissions over 3 – 5 years.

Not all sales commissions are expensed over time though. Some are expensed immediately. Only sales commissions that are solely dependent on the contract getting signed are deferred and expensed over time. All other sales commissions are expensed immediately.

So AEs and their managers would almost always be capitalized and expensed over time since they only get paid if the deal is signed, but SDRs whose commission is based on setting up meetings are expensed immediately.

Other income (expense)

- Interest expense and income

- foreign exchange gains and losses

- Investment gains and losses

Income Tax Expense

As crazy as it might sound to some SaaS companies, eventually the goal is to be profitable and make money. Once this crazy phenomenon happens a company will owe income taxes.

But income taxes might be owed before a company is profitable.

- Foreign entities: If a company has set up foreign entities, then based on the tax laws there will usually be income taxes owed in these foreign jurisdictions.

- Financial net income doesn’t equal taxable income: Not going to explain all of this, but there are lots of differences so a company might have taxable income before financial statement income.

- Change in tax laws for research and development expenses. This may actually be a pretty big deal if it doesn’t get repealed. See the Twitter thread below

Concluding Thoughts

All investors and business operators should understand the basics of an income statement. If you don’t understand an income statement then mistakes will be made in allocating capital and making investment decisions. Source: @OnlyCFO