Economic Impact Assessment of the Mill Enterprise Centre Drogheda

Download Economic Impact Report here

1. Introduction

This report is prepared for the Mill Enterprise Centre by Dr. Pat McCloughan, Managing Director of PMCA Economic Consulting. It presents the results of an economic impact assessment study of the Mill with reference to the following economic impact variables:

• Employment;

• Gross value added (GVA);

• Exchequer revenue.

Employment is measured in full-time equivalents (FTEs) while GVA and Exchequer revenue are monetary variables captured in euro (€). Generally speaking, GVA is the monetary value of output less intermediate consumption of goods and services used as inputs in the production process and gives the contribution (of a business, an enterprise centre like the Mill or a region etc.) to a country’s national income in the form of gross domestic product (GDP). Exchequer revenue refers to total tax revenue to the Irish State.

The economic impact analysis carried out in this study is based on the activities of both the Mill’s tenants (‘Millers’) and its own staff, which comprise a Director of Business, Innovation and Enterprise, a Facilities Manager and a Maintenance Support person.

About the Mill

The Mill is Drogheda’s first and principal enterprise centre. It opened in 2014, on lands in the northern environs of the town provided by Louth County Council with funding support from public bodies and businesses in the region. Attractively located with high quality office spaces for varying sizes of tenants, hot desk facilities (floating and fixed, in open plan and within offices), meeting rooms, audio-visual and studio facilities, kitchen/catering space and car parking, the Mill doubled its original size in 2016 to its current gross floor area of 1,394m2 (c. 15,000 ft). Presently there are 43 Millers in the building employing 103 people on an FTE basis. Among the Millers are 11 foreign direct investment (FDI) businesses which together employ 43 people on a FTE basis.

2. Methodology

The Mill provided Dr. McCloughan with information regarding the direct employment (FTEs) and economic activities of the Millers, to which Dr. McCloughan added further data obtained from the Central Statistics Office (CSO) regarding employment and value added in respect of the sectors of the Irish economy in which the Millers are active. The approach obviated the need to seek sensitive financial information from the tenants, which otherwise could have restricted participation in the study. The information assembled permitted the derivation of the direct GVA impact of the Mill. Using further information obtained from the Organisation for Economic Cooperation and Development (OECD), Dr. McCloughan then derived the direct Exchequer contribution from those at work in the Mill.1

Then, to estimate the knock-on economic impacts for each of the employment, GVA and Exchequer contribution variables, Dr. McCloughan applied economic impact multipliers for the relevant sectors of the Irish economy in respect of the Mill. Generally speaking, economic impact multipliers enable estimation of the knock-on economic impacts of a direct stimulus to the economy. To estimate the knock-on economic impacts arising from the direct impacts for each of the GVA, employment and Exchequer contribution variables in this study, we employ the well-established methodology of economic impact multipliers, which enable estimation of the indirect and induced impacts from the direct impacts.

Indirect impacts generally refer to the knock-on economic impacts occurring in intermediate production, including along the supply chain, while induced impacts refer to the knock-on economic impacts at final demand level. For instance, Millers transact with other businesses locally in Drogheda, the wider North East Region and the State more generally, which pertain to indirect impacts; while a proportion of the income generated from the work of the Millers is spent in various shops, restaurants and hotels etc. locally and in the country, which refers to the induced impacts. Together, the direct, indirect and induced impacts make up the total economic impacts for each employment, GVA and Exchequer contribution.

Type I economic impact multipliers enable estimation of the indirect impacts of a given sector on all other sectors of the Irish economy, while Type II economic impact multipliers allow estimation of both the indirect and the induced impacts, so that the difference between Type II and Type I multipliers permits derivation of the induced effects.

Only one source of data is amenable for estimation of Type I and Type II economic impact multipliers for the various sectors of the Irish economy. The data in question are the CSO’s supply-and-use and input-output tables. These are published by the CSO every number of years and show the interactions among the various sectors (50+) of the Irish economy. The latest available supply-and-use and input-output tables are for 2015 (the data were published by the CSO on 23 October 2018).2 In that release, the CSO published estimates of Type I output multipliers for each sector, which were independently confirmed by Dr. McCloughan (as part of the process of deriving all economic multipliers based on that data).

In this study for the Mill, the indirect and induced impacts were derived for the economic impact variables as follows:

• Employment – Type I and Type II employment multipliers for the relevant sectors concerned (i.e. those sectors in which the Millers and the Mill staff are active);

• GVA – Type I and Type II GVA multipliers for the same sectors; and

• Exchequer revenue – Type I and Type II income multipliers are the same sectors.

3. Summary of the Results of the Economic Impact Assessment

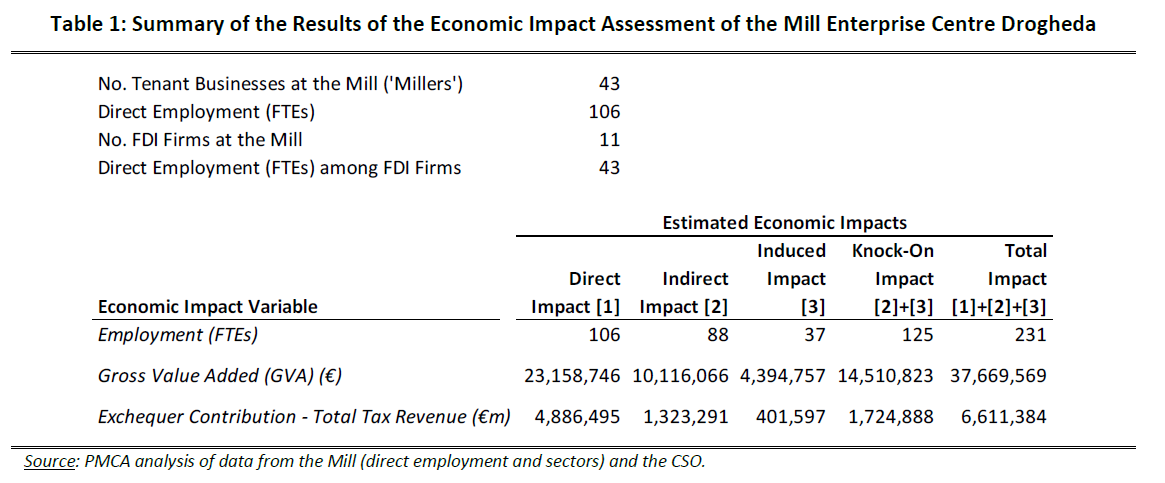

The results of the economic impact assessment are summarised in Table 1 below. The key findings are:

1. The 106 direct FTEs at work in the Mill are associated with the creation or sustenance of an additional 125 FTEs elsewhere in the Irish economy through both indirect (i.e. supply-chain) and induced (i.e. final demand) impacts, which implies that each person at work in the Mill is associated with 1.2 persons at work elsewhere in the economy.

2. The total employment impact of the Mill is therefore 231 FTEs.

3. The direct GVA contribution of the Mill is €23,158,746 and the total GVA contribution on incorporation of both indirect and induced impacts is €37,669,569.

4. Direct GVA per direct FTE at the Mill is €218,479, which is consistent with other sources of information regarding the economic impact of indigenous and foreign-owned enterprises in the State (for example, the Department of Enterprise, Trade and Employment’s Annual Business Survey of Economic Impact, ABSEI).

5. The direct Exchequer revenue contribution of the Mill is €4,886,495 and the total Exchequer contribution is €6,611,384.3

4. Conclusion

The economic impact of the Mill is significant, as evidenced by the estimate from the analysis conducted in this study that each person at work in the facility in Drogheda on average contributes direct GVA to the value of €218,479 to the national economy per annum. This illustrates the high quality and productive nature of the economic activities in which the Millers are active.

Secondly, the employment impact of the Mill is appreciably large – each person at work in the enterprise centre is associated with the creation or sustenance of 1.2 persons at work elsewhere in the Irish economy.

Footnotes

- Specifically, the OECD publication ‘Revenue Statistics 2022: The Impact of COVID-19 on OECD tax revenues’ which shows that total tax revenue as a proportion of GDP in Ireland in 2021 was 21.1% (it was 21.9% in 2019, pre-COVID).

- Dr. McCloughan understands from the CSO that the next set of supply-and-use and input-output tables will be published later this year and pertain to 2020. The CSO’s previous supply-and-use and input-output tables (for 2011) were released on 16 December 2014. The timing of the publication of these data illustrates the extent of work involved in their production.

- However, the knock-on (i.e. both the indirect and induced) impacts associated with the Exchequer revenue economic impact variable should be treated with caution given government discretion in respect of the uses to which revenue is used.

About PMCA

PMCA Economic Consulting is an Irish-owned practice active in the provision of evidence-based economic analysis to clients in the public, private and other sectors in Ireland and other countries. The firm was founded in 2010 by Dr. Pat McCloughan, a leading consultant economist with over 30 years’ professional experience in Ireland, the UK and internationally. A PhD-educated economist with an established publication record in peer-reviewed economics journals and advanced skills in statistics and econometrics, Dr. McCloughan is active in economic impact assessment, economic appraisal, competition, regulation, litigation support as an expert witness economist, and economic strategy.

During 2001-2010, Dr. McCloughan worked in a senior capacity with another economic consulting firm with offices in Dublin, London and Europe, and between 1993 and 2001 he was employed at the University of Liverpool – as a Lecturer in Economics and during 1998-2001 he was also Director of Undergraduate Studies in the Department of Economics, Finance and Accounting, which became part of the University of Liverpool Management School. During 1991-1993, Dr. McCloughan was a Lecturer in Economics at the University of East Anglia, Norwich in the UK, where he obtained his PhD in Economics.

Dr. McCloughan is known and respected for the integrity and independence of his work. Clients include central government departments, local authorities, State agencies, educational institutions, private sector enterprises and business representative organisations.

Dr. McCloughan’s qualifications are: BA (Hons) Economics and Mathematics (National University of Ireland Galway, NUIG); MA Economics (NUIG); and PhD Economics (University of East Anglia, UK).

He has published in peer-reviewed journals, including The Journal of Industrial Economics, Applied Economics, The International Journal of Industrial Organisation, Construction Management and Economics, Applied Economics Letters, The Economic and Social Review and The Journal of the Statistical and Social Inquiry Society of Ireland (the latter two journals are the leading economics journals in Ireland). He has also published in Global Competition Review, The Journal of Cross Border Studies in Ireland, Telecommunications Policy, European Competition Law Review and Pleanáil – Journal of the Irish Planning Institute.

Among Dr. McCloughan’s contributions to the field of economics are original techniques for estimating economic inequalities and concentration given pre-grouped data (in tandem with Dr. Esmaiel Abounoori, Professor of Econometrics and Social Statistics at Semnan University in Iran, who originally met Dr. McCloughan whilst a Visiting Fellow at the University of Liverpool in the early 1990s).

Dr. McCloughan’s contact details are as follows:

Dublin

30 Pembroke St. Upper

Dublin 2

Ireland

D02 NT28

T: +353 1 234 2507

M: +353 86 3576461

E: pat@pmca.ie

Drogheda

The Mill Enterprise Centre

Newtown Link Road

Stagreenan

Drogheda

A92 CD3D

M: +353 86 3576461

E: pat@pmca.ie