Economic Impact Assessment of the Mill Enterprise Centre Drogheda

The Economic Impact of the Mill Enterprise Centre Drogheda 2014-2024 (Click to download PDF)

12 April 2024

Introduction

This year marks the 10th anniversary of The Mill Enterprise Centre in Drogheda. To celebrate the occasion, the Board and Management of The Mill are hosting a special event on 10 May 2024 which will see the launch of a new Strategy for The Mill and a report on the Economic Impact of the Mill covering the period 2014-2024. The latter has been prepared by Dr. Pat McCloughan, Managing Director of PMCA Economic Consulting, who is among current crop of ‘Millers’ (tenants of The Mill).

The economic impact assessment has been carried out with reference to the economic impact variables:

• Employment;

• Gross value added (GVA); and

• Exchequer contribution (i.e. revenue to the Irish Government).

Employment is measured in full-time equivalents (FTEs) while GVA and Exchequer revenue are monetary variables captured in euro (€). Generally speaking, GVA is the value of output less intermediate consumption of goods and services used as inputs in the production process and gives the contribution (of a business, an enterprise centre like The Mill or a region etc.) to a country’s national income in the form of gross domestic product (GDP).

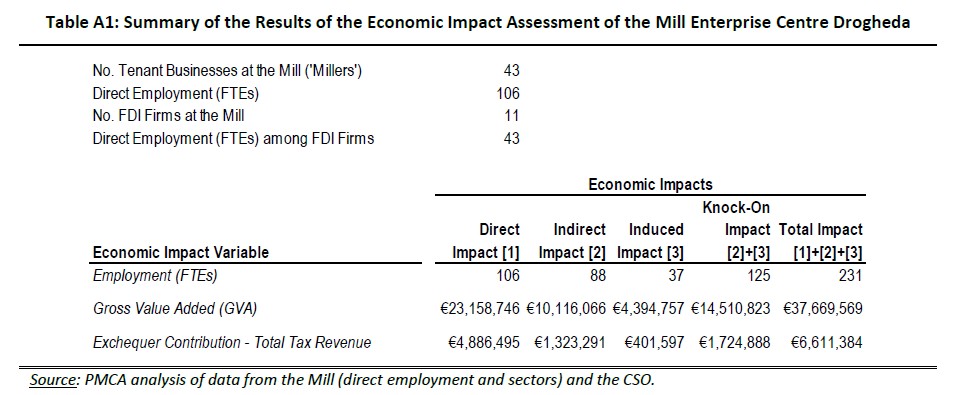

The economic impact study is based on the numbers and activities of the Millers and The Mill’s own staff in each year during 2014-2024 (there are three staff of the organisation – Director, Facilities Manager and Maintenance Support).1 This study builds on the work previously carried out for The Mill by Dr. McCloughan in January 2023 regarding The Mill’s economic impact in that year, the results of which are summarised in the Annex to this report (Table A1).

About The Mill

The Mill opened in 2014, on lands in the northern environs of the town provided by Louth County Council with funding support from public bodies and businesses in the region. Attractively located with high quality office spaces for varying sizes of tenants, hot desks (floating and fixed), meeting rooms, audio-visual and studio facilities, kitchen/catering space and car parking spaces for Millers, guests and clients of Millers (including electric charging spaces presently).2 The Mill doubled its original size in 2017 to its present gross floor area of 1,394m2 (c. 15,000 ft). Currently there are 100 people at work in The Mill, comprising 97 people at work in the tenants of The Mill and The Mill’s three staff. The peak level of employment in The Mill to date occurred last year with 144 people (both Millers and The Mill’s staff).

Methodology

The starting point for the study was to download electronically from the website of the Central Statistics Office (CSO) data on GVA and employment for each and every sector in the State from 2014 to the latest available year (2023). The GVA data were obtained from the CSO’s output and value added database and the employment data from the organisation’s Labour Force Survey (LFS) results (both datasets are publicly available from the CSO’s website).

The CSO’s LFS data are quarterly (i.e. four observations per year) and the data for the third quarter of each year were used (2014Q3, 2015Q3 etc.) (which tends to be standard practice in studies of this nature). The latest year covered by the LFS is 2023, necessitating informed estimates by sector for the current year. Calculating the compound annual growth rate (CAGR) 2014-2023 for each and every sector and then applying the CAGR to the level of employment in 2023 permitted an informed estimate of each sector’s level of employment in 2024.

The latest year in the CSO’s output and value added database is 2022 and, similar to the analysis of the LFS data, estimation of each sector’s GVA CAGR (2014-2022) permitted the derivation of informed estimates of GVA for all sectors in the CSO’s database for 2023 and 2024.

Then, using the CSO GVA and employment data assembled for 2014-2024, the ratio of GVA to employment (i.e. GVA/employment) was derived for each sector in each year of the period, which would then be applied to the data assembled by The Mill on the numbers of FTEs by sector for each and all of the tenants during 2014-2024, thereby enabling derivation of the direct employment and direct GVA impacts for each year.

A benefit of the methodological approach used in this study is that it obviated the need to seek any commercially sensitive information from past or current Millers, which otherwise would have significantly restricted and/or delayed (or prevented in practical terms) the study from being carried out.

With the direct estimates of GVA per year during 2014-2024, and further information obtained from the Organisation for Economic Cooperation and Development (OECD), Dr. McCloughan was then able to estimate the corresponding direct Exchequer contribution or tax revenue due to the Mill.3

Thus, at this stage in the data analysis, the direct estimates of GVA, employment and Exchequer contribution (or tax revenue) due to the Mill in each year during 2014-2024 are accounted for.

To estimate the corresponding knock-on economic impacts for each of the employment, GVA and Exchequer contribution/tax revenue variables, Dr. McCloughan applied economic impact multipliers for the relevant sectors of the Irish economy in respect of the tenants of the Mill.

Generally speaking, economic impact multipliers enable estimation of the knock-on economic impacts of a direct stimulus to the economy comprising both the indirect and induced impacts associated with the estimated direct GVA, employment and tax revenue impacts. Indirect impacts refer to the knock-on economic impacts occurring in intermediate production, including along the supply chain, while induced impacts refer to the knock-on economic impacts at final demand level.

For instance, Millers transact with other businesses locally in Drogheda, the wider North East Region and the State more generally, all of which pertain to indirect impacts. At the same time Millers will also spend a proportion of their incomes in shops, restaurants and hotels etc. locally and in the country, which are the induced impacts.

Together, the direct, indirect and induced impacts make up the total economic impacts for each of the employment, GVA and Exchequer contribution economic impact variables in this study.

Type I economic impact multipliers enable estimation of the indirect impacts of a given sector on all other sectors of the Irish economy, while Type II economic impact multipliers allow estimation of both the indirect and the induced impacts, so that the difference between Type II and Type I multipliers permits derivation of the induced effects.

Only one source of (publicly available) data is amenable for estimation of Type I and Type II economic impact multipliers for the various sectors of the Irish economy. The data in question are the CSO’s supply-and-use and input-output tables. These are produced and published by the CSO every number of years and show the interactions among the various sectors (50+) of the Irish economy. The latest supply-and-use and input-output tables for Ireland were published in early December 2023 and pertain to 2020. The previous such tables were published by the CSO in October 2018 and pertain to 2015 and before that the supply-and-use and input-output tables for 2011 were published by the CSO in December 2014. The timing of the publication of successive generations of these tables, which are critically important for conducting economic impact assessments, illustrates the extent of work involved in their production (by the CSO).

In each of the latest and past releases of the supply-and-use and input-output tables, the CSO published estimates of Type I output multipliers for each sector of the Irish economy but did not publish any of the other types of multiplier for the sectors of the Irish economy (namely the Type II output multipliers, the Types I and II GVA multipliers, the Types I and II employment multipliers and the Types I and II income multipliers). Nonetheless, on each occasion of the CSO’s publication of the supply-and-use and input-output tables for the various sectors of the Irish economy in 2014 (for 2011), 2018 (for 2015) and 2023 (for 2020), Dr. McCloughan independently confirmed all of the CSO’s published Type I output multipliers before proceeding to estimate all of the other types of multiplier as described.

In this study, the indirect and induced impacts were derived for the economic impact variables as follows:

• Employment – Type I and Type II employment multipliers for the relevant sectors concerned (i.e. those sectors in which the Millers and The Mill staff are active);

• GVA – Type I and Type II GVA multipliers for the same sectors; and

• Exchequer revenue – Type I and Type II income multipliers are the same sectors.

Results of the Economic Impact Assessment

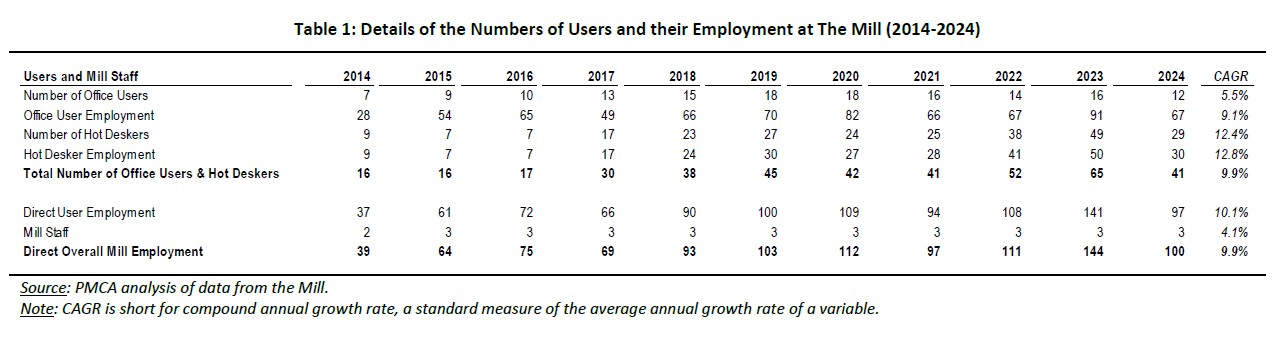

Table 1 overleaf sets out information on the numbers of users of The Mill and their direct employment over the past ten years (2014-2024).

Broadly speaking there are two types of user at The Mill:

• Office users who have self-contained offices; and

• Hot desk users whose hot desks may be fixed or floating in open plan or within a room.

In its first year in 2014, there were 7 office users who together employed 28 people and 9 hot deskers with that number at work in The Mill. In the latest full year (2023), the number of office users was 16 with employment of 91 and there were 49 hot deskers with 50 people at work in this category.

Thus, in 2023, the total number of people at work in The Mill was 141. Adding the three staff of The Mill meant that the total direct employment was 144 in that year, which represented the highest level of people at work in The Mill since its foundation. Currently, in 2024, there are 100 people at work in The Mill (tenants and The Mill staff) comprising 97 people at work in tenants and the three Mill staff.

The final column of Table 1 shows CAGRs (compound annual growth rates) (which measure the average annual growth rate during the period 2014-2024). The analysis reveals that employment at The Mill has grown strongly during the ten-year period by 10% and it is concluded that the rates of growth in Table 1 (the CAGRs) are high by any comparison.

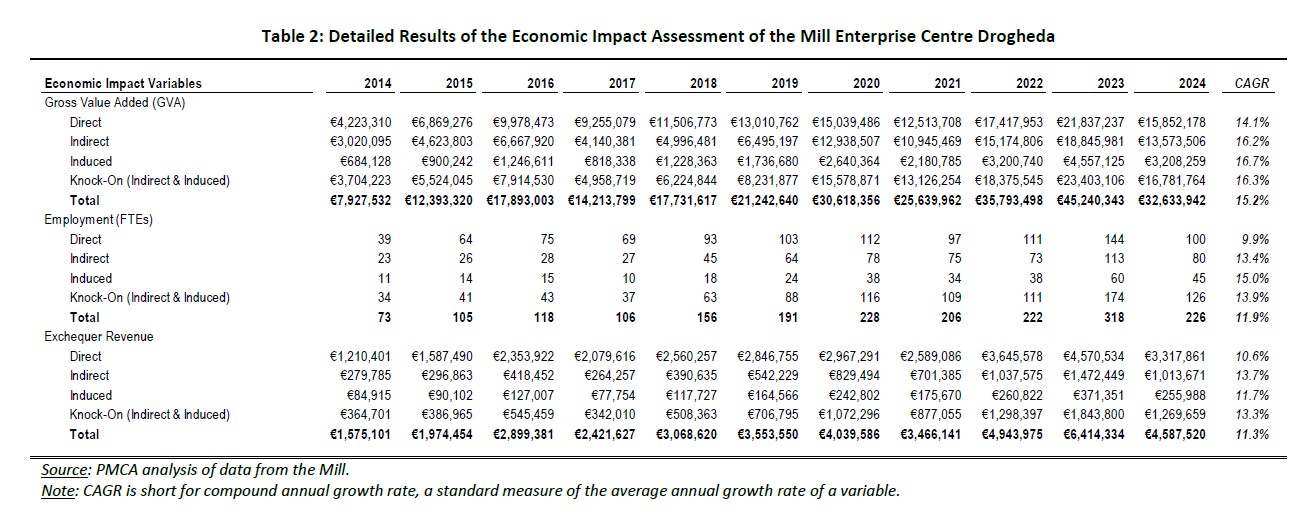

Next, the detailed results of the economic impact assessment of The Mill for each year during 2014-2024 are set out in Table 2 below. The following are particularly noteworthy.

First, the total GVA impact of The Mill (taking into account the activities of the Millers and The Mill staff in each year) grew from €7,927,532 in 2014 to €32,633,942 in 2024, with the highest such impact to date occurring in 2023 at €45,240,343. This figure exceeds the estimate of €37,669,569 which resulted from the economic impact study of The Mill carried out by Dr. McCloughan in early 2023. The details of the results from that study are reproduced in the Annex to this report. With reference to Table A1, the previous estimate for 2023 was based on the number and profile of the Millers in early 2023, which had 43 tenants employing 106 people (directly). With the benefit of time, 2023 proved to be the most successful year (yet) for The Mill, with 65 office users and hot deskers together employing 141, in addition to the three staff running The Mill.6

Second, the cumulative total GVA impact attributed to The Mill during 2014-2024 is €261,328,013 or €261.3 billion.

Second, in the latest full year for which data are available (2023), the 144 people directly at work in The Mill (comprising 141 among the tenants and the three Mill staff) gave rise to additional, knock-on employment in the Irish economy of 174 through both indirect and induced impacts, leading to the total employment impact of The Mill in that year of 318 jobs.

Thirdly, the activities of The Mill and its Millers also give rise to revenue to the Government, the total impacts of which are also estimated in this report. In the peak year of The Mill to date (2023), the estimated total revenue contribution is €6,414,334 (comprising the direct, indirect and induced impacts) and over the whole period 2014-2024 the total revenue contribution attributed to The Mill is €38,933,289.

Conclusion

Based on information regarding the numbers and activities (sectors) of The Mill’s tenants in each year during 2014-2024 received from The Mill, this study has estimated the economic impacts of The Mill Enterprise Centre in Drogheda and the noteworthy results are as follows:

• 2023 was a record year for The Mill, with direct employment of 144 (comprising 141 among The Mill’s tenants and the three staff at The Mill), which in turn gave rise to knock-on employment in the Irish economy of 174 or 318 in total;

• In that year, the total GVA (gross value added) impact of The Mill was €45,240,343, the highest figure to date (this figure includes the direct, indirect and induced GVA impacts of The Mill and its tenants) (generally speaking, GVA gives the contribution to a country’s GDP (gross domestic product), the conventional and most widely used measure of national income); and

• During 2014-2024, the cumulative total GVA impact of The Mill is estimated at €261,328,013 and the corresponding cumulative total impact in respect of Exchequer revenue is €38,944,289.

• The success of The Mill to date is also manifested by the growth in the number of people working there (‘Millers’) – from 37 in 2014 to 141 in 2023 and 97 currently.

Annex of Supplementary Information

The following table reproduces the results of the economic impact assessment of The Mill Enterprise Centre carried out for The Mill by Dr. Pat McCloughan in January 2023.

About PMCA

PMCA Economic Consulting is an Irish-owned practice active in the provision of evidence-based economic analysis to clients in the public, private and other sectors in Ireland and other countries. The firm was founded in 2010 by Dr. Pat McCloughan, a leading consultant economist with over 30 years’ professional experience in Ireland, the UK and internationally. A PhD-educated economist with an established publication record in peer-reviewed economics journals and advanced skills in statistics and econometrics, Dr. McCloughan is active in economic impact assessment, economic appraisal, competition, regulation, litigation support as an expert witness economist, and economic strategy.

About PMCA

PMCA Economic Consulting is an Irish-owned practice active in the provision of evidence-based economic analysis to clients in the public, private and other sectors in Ireland and other countries. The firm was founded in 2010 by Dr. Pat McCloughan, a leading consultant economist with over 30 years’ professional experience in Ireland, the UK and internationally. A PhD-educated economist with an established publication record in peer-reviewed economics journals and advanced skills in statistics and econometrics, Dr. McCloughan is active in economic impact assessment, economic appraisal, competition, regulation, litigation support as an expert witness economist, and economic strategy.

During 2001-2010, Dr. McCloughan worked in a senior capacity with another economic consulting firm with offices in Dublin, London and Europe, and between 1993 and 2001 he was employed at the University of Liverpool – as a Lecturer in Economics and during 1998-2001 he was also Director of Undergraduate Studies in the Department of Economics, Finance and Accounting, which became part of the University of Liverpool Management School. During 1991-1993, Dr. McCloughan was a Lecturer in Economics at the University of East Anglia, Norwich in the UK, where he obtained his PhD in Economics.

Dr. McCloughan is known and respected for the integrity and independence of his work. Clients include central government departments, local authorities, State agencies, educational institutions, private sector enterprises and business representative organisations.

Dr. McCloughan’s qualifications are: BA (Hons) Economics and Mathematics (National University of Ireland Galway, NUIG); MA Economics (NUIG); and PhD Economics (University of East Anglia, UK).

He has published in peer-reviewed journals, including The Journal of Industrial Economics, Applied Economics, The International Journal of Industrial Organisation, Construction Management and Economics, Applied Economics Letters, The Economic and Social Review and The Journal of the Statistical and Social Inquiry Society of Ireland (the latter two journals are the leading economics journals in Ireland). He has also published in Global Competition Review, The Journal of Cross Border Studies in Ireland, Telecommunications Policy, European Competition Law Review and Pleanáil – Journal of the Irish Planning Institute.

Among Dr. McCloughan’s contributions to the field of economics are original techniques for estimating economic inequalities and concentration given pre-grouped data (in tandem with Dr. Esmaiel Abounoori, Professor of Econometrics and Social Statistics at Semnan University in Iran, who originally met Dr. McCloughan whilst a Visiting Fellow at the University of Liverpool in the early 1990s).

Dr. McCloughan’s contact details are as follows:

Dublin

30 Pembroke St. Upper

Dublin 2

Ireland

D02 NT28

T: +353 1 234 2507

M: +353 86 3576461

E: pat@pmca.ie

Drogheda

The Mill Enterprise Centre

Newtown Link Road

Stagreenan

Drogheda

A92 CD3D

M: +353 86 3576461

E: pat@pmca.ie